$94 VA Cost of Living Increase in 2025: Individuals who are getting monthly benefits from the department of veteran affairs in USA will receive extra VA benefits payment from 2025 onwards. Family members of the survivors and they both are eligible to apply for multiple programs running by the department of VA.

According to the latest updates by department of VA in the country, individuals can get approximately $94 VA Cost of Living extra payment along with their regular payout by the VA benefit programs. So if you are eligible to get the $94 VA Payment then should check the latest updates by the authority which will help you to avail the 100% benefit of the program and you can the additional payment too.

$94 VA Cost of Living Increase in 2025

The department of veterans affairs is Managing Benefits program for the veterans who worked in US forces and get disability during the service. Apart from the beneficiary, the family members of the beneficiaries are also getting financial assistance for multiple purposes including educational purpose, medical purpose etc.. from the department accordingly.

The Government of USA has increased cost of living adjustment- COLA rates in the country for the financial year of 2025. Beneficiaries who are getting financial assistance from the government in USA will get 2.5% hike in their payments {$94 VA Payment} from 2025. So as per the details, it will be approximately additional $94 amount which will be increased in the regular benefits of the VA beneficiaries in the country.

$94 VA Cost of Living Increase in 2025: Brief Overview

| Details | Key Information |

| COLA Rate for 2025 | 2.5% |

| First Payment | January 2025 (typically on the first business day of the month) |

| Increase | $94 for veterans with a 100% disability rating |

| Eligibility | Veterans with service-connected disabilities receiving VA compensation |

| Source for latest updates | https://www.va.gov/ |

EPFO 3.0 New facility for employees, Eased PF Withdrawal Norms

What Is VA Cost of Living Adjustment (COLA)?

The Cost of Living Adjustment (COLA) is an annual increase in benefits to account for inflation and rising living expenses. This ensures that veterans’ disability compensation keeps pace with economic changes. This adjustment is based upon the Consumer Price Index (CPI), which measures the average change in prices over time for goods and services.

For veterans with a 100% disability rating, this 2.5% increase translates to an estimated monthly boost of $94. For those with other disability ratings, the percentage remains consistent, but the dollar amount varies depending on the level of compensation. The new payment rates is reflected in January 2025 payments, making this a welcome relief for many who depend on these benefits for their day-to-day living expenses.

Benefits of COLA hike in VA Payments

Currently applicants are getting 4,387.79 Amount from the government For monthly basis for those who have 100% disability and living with their spouse and 2 children. However the maximum amount is prepared according to the disability percentage of the applicant and the family criteria of the applicant which is ranged between 175.51 to 4,387.7 USD.

However these individuals will get 2.5% extra payment of their amount as per the COLA increments. so it will be Maximum increment of $109.6 for 100% disabled’s and $4.3 for 10% disabled beneficiaries.

How much beneficiaries will get?

If you are an eligible veteran for Disability benefits Program then you will get your payment according to your disability percentage. Percentage of disability is ranged between 10% to 100%. As much you have disability, the payment will automatically increase.

Apart from it, the number of family including spouse and children will also impact on your overall monthly payouts. You can check the following table to know the detailed overview of upcoming payments for VA disable beneficiaries:

| Disability Percentage | Monthly Amount for Single Applicants | After 2.5% COLA Hike |

| 10 % | 175.51 | 4.39 |

| 20 % | 346.95 | 8.67 |

| 30 % | 537.42 | 13.44 |

| 40 % | 774.16 | 19.35 |

| 50 % | 1,102.04 | 27.55 |

| 60 % | 1,395.93 | 34.90 |

| 70 % | 1,759.19 | 43.98 |

| 80 % | 2,044.89 | 51.12 |

| 90 % | 2,297.96 | 57.45 |

| 100 % | 3,831.30 | 95.78 |

How to Claim the $94 VA Cost of Living Increase Payment?

If you are also a beneficiary who got disabled during service in Army, then you can apply for the disability benefits through online mode on the official website of department of veteran affairs by following this procedure :-

- First of all visit to the official website of US department of veterans affairs.

- After that you have to search for the disability benefits under the program section

- Now you will reach the new page where you can see all the important details of the program including the eligibility criteria and the link to apply through online mode

- Once you click on the link of File for disability compensation with VA Form 21-526EZ, you will see the login session where it need to provide your whether Idea and password

- Now you need to fill the application form in the page where you will be asked to provide your all the important details and disability conditions along with your family details and your annual income accordingly.

- At the end you need to submit all the important details to verify your information on the application page.

After that authority will check your details and will soon contact you for the verifications. once the verification complete you will able to get your payment in bank account directly.

CUET-UG 2025: ‘Computer-Based Test Returns, Any Subject Choices Allowed’ Says UGC Chairman

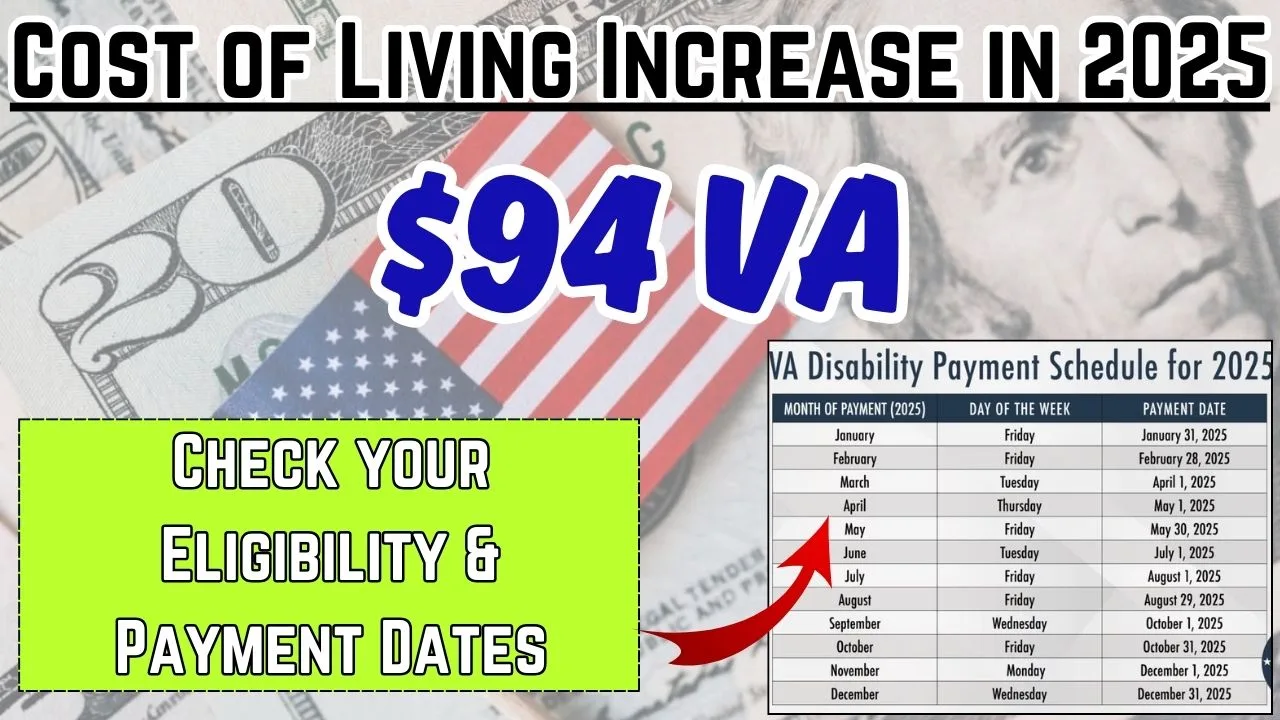

VA Payment Schedule for 2025

• January – Friday, January 31

• February – Friday, March 1

• March – Monday, April 1

• April – Wednesday, May 1

• May – Friday, May 31

• June – Monday, July 1

• July – Thursday, August 1

• August – Friday, August 30

• September – Tuesday, October 1

• October – Friday, November 1

• November – Friday, November 29

• December – Tuesday, December 31

COLA Increase in 2025

The COLA rates from 2020 to 2025 have exhibited a fluctuating trend, reflecting the dynamic nature of inflation. After a modest 1.3% increase in 2020, the rate surged to 5.9% in 2021, likely driven by pandemic-related economic disruptions. In 2022, the COLA reached a 40-year high of 8.7%, aligning with elevated inflammation levels.

However, as inflationary pressures began to ease, the COLA decreased to 3.2% in 2023. The projected 2.5% increase for 2025 indicates a further moderation in the rate of inflation. Overall, the COLA rates during this period underscore the importance of monitoring economic conditions and adjusting benefits to maintain purchasing power for beneficiaries.

FAQ’s: $94 VA Cost of Living Increase in 2025

Do I have to submit an application for the COLA increase?

No, VA benefits automatically reflect the COLA increase.

When will the adjusted payment to be sent to beneficiaries?

On January 2, 2025, the first payment covering December 2024 benefits was made, reflecting the 2 percent COLA increase. The next will be released soon.

Are benefits from the VA taxable?

No, COLA adjustments and other VA disability benefits are not taxable.