Singapore CPF Contribution Table 2025: One of the principle pillars of Singapore’s social safety strategy is the Central Provident Fund (CPF) gadget, which offers financial protection in any respect tiers of life. Contributions to the CPF, which became created to help citizens and everlasting citizens (PRs) in saving for necessities, include retirement, housing, and healthcare. Employer and employee contributions are combined in this plan to promote long-term financial security and stability.

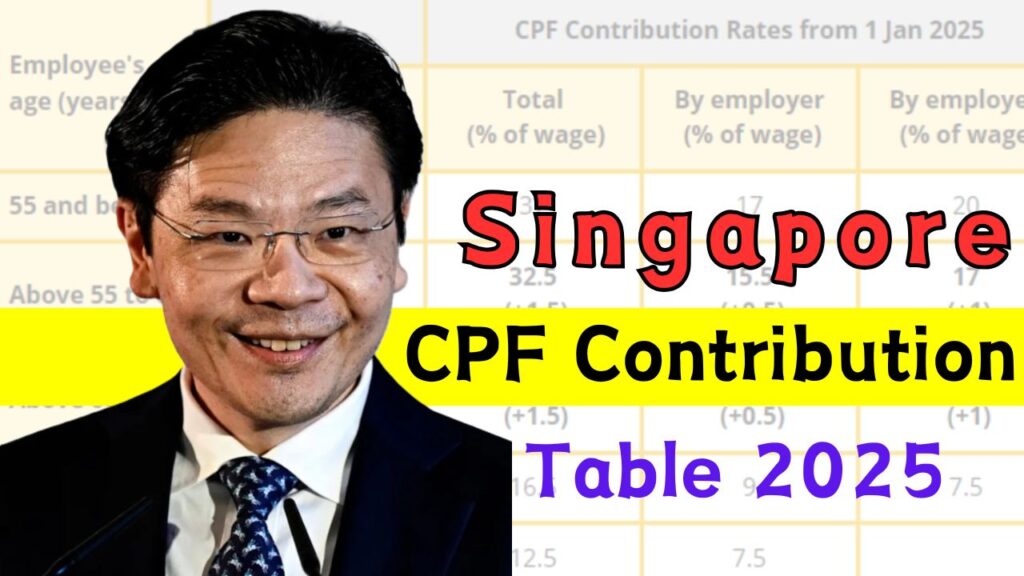

A tiered machine is used to shape CPF contributions, accounting for differences in earnings, paintings fame, and age. New contribution rates, which cross into impact on January 1, 2025, are supposed to boom financial savings potential whilst maintaining affordability for both employers and employees. By placing a balance between immediate economic responsibilities and lengthy-time period economic making plans, these modifications are intended to satisfy the changing needs of Singapore’s staff.

Additionally, the CPF system is essential in encouraging citizens and PRs to develop disciplined saving practices and financial literacy. CPF continues to promote the social welfare and economic resilience of the country with its thorough coverage and methodical approach.

Comprehending CPF Contributions

The CPF receives contributions from employers and employees. The employee’s age, income, and citizenship status all affect the rates. The employee’s whole salary, which incorporates both Ordinary Wages (OW) and Additional Wages (AW), is the idea for contributions.

- Ordinary Wages (OW): CPF contributions are capped at $7,400 consistent with month.

- Bonuses and other non-recurring payments with contribution caps based on yearly income are known as additional wages (AW).

In addition to offering financial stability, the CPF system encourages employees to save and take responsibility for their actions. A tiered system is used to calculate CPF contributions.

Rates of CPF Contribution for Singaporean Nationals

Singaporean citizens and third-year students have different CPF contribution rates depending on their age group. The key categories are summarized as follows:

Age 55 and Below

| Monthly Wages | Total Contribution Rate | Employee’s Share | Employer’s Share |

| ≤ $50 | Nil | Nil | Nil |

| $50 – $500 | 17% | Nil | 17% |

| > $750 | 37% | 20% | 17% |

Age 55 to 60

| Monthly Wages | Total Contribution Rate | Employee’s Share | Employer’s Share |

| > $750 | 32.5% | 17% | 15.5% |

Age 60 to 65

| Monthly Wages | Total Contribution Rate | Employee’s Share | Employer’s Share |

| > $750 | 23.5% | 11.5% | 12% |

This methodical approach guarantees that CPF contributions are sustainable and balanced throughout various life stages, assisting staff members in building up funds for retirement, housing, and medical expenses.

How to Determine Your CPF Contributions?

Although calculating CPF contributions may appear difficult, accuracy is ensured by following these steps:

- Total wages are calculated by adding OW and AW.

- Depending on your age and income level, use the appropriate rate.

- For accuracy, adhere to rounding rules.

- To calculate the employer’s share, from the total contribution subtract the employee’s share.

The Value of CPF Payments

Contributions to the CPF are essential to creating a stable financial future. The money provides for necessities like:

- Healthcare: Employees can save money for insurance premiums and medical costs by using the MediSave account. In times of medical emergency, this lessens the financial strain.

- Housing: CPF funds can be used to service housing loans or buy HDB apartments, encouraging stability and homeownership.

- Retirement: Savings in a CPF account provide protection and peace of mind by guaranteeing a consistent income following retirement.